Your social media accounts are places where you can connect with others. They are platforms where you can seek entertainment or seek to entertain. They are places where you can market and grow your business.

What you might not realize, however, is that your social media accounts may also be used for a very different purpose. Those accounts you use to try to grow your brand could impact your ability to borrow money for your business as well.

Why Commercial Credit Bureaus Use Social Media

Lenders are turning to social media to assess borrowers! Posted September 18, 2017 June 1, 2020 CAPrice webmaster VISITING the homes of poor Africans who want to borrow money helps Finca International, an American microfinance firm, weed out likely deadbeats. Having a social media presence has never been more important for loan officers to connect with potential borrowers. Learn how to develop loan officer social media strategies to increase your business opportunities. Our mortgage professional insights about social media will assist in building your online presence. Social media i s a crowded space, and using images is a great way to grab attention. A social media post accompanied by a photo is ten times more likely to get engagement.

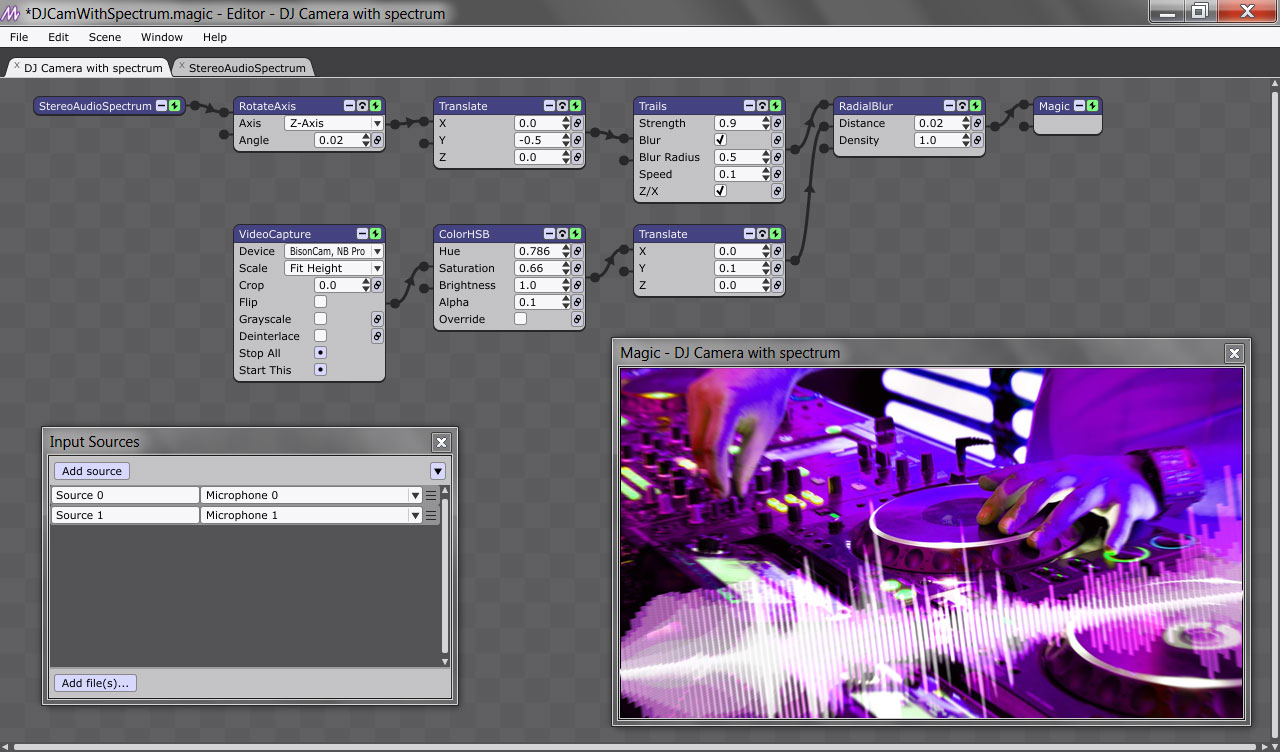

Plane9 is a Music Visualizer and 3D effects for Windows. One of the functions that many users miss in their music players is the viewer. This function allowed us to play a series of effects that varied according to the music that was playing in real time on the computer. Spectrum is Music Visualizer app. This app generates some visual effects from your music library or microphone. Tap the music button. Best Music Visualizers For PC And Mac 6. MilkDrop 2 This software is a music visualizer for Windows PC and works as a plug-in with the Winamp music player.

Commercial lenders want access to as much information as possible when making decisions about whether or not to approve your business for financing. Information helps commercial lenders to better predict risk and to determine if doing business with your company is a good idea. Information is king.

Do Business Lenders Care About Social Media Accounts

The goal of commercial credit bureaus—like Dun & Bradstreet, Equifax, and Experian—is to provide business lenders with the information they want along with tools which make the process of predicting risk easier and more accurate. In fact, commercial credit bureaus regularly compete with each other to produce and market the most predictive products available.

Why? Just like your business they want to beat out the competition and gain as many customers as possible. Adding alternative data from business social media sources is one way that some commercial credit bureaus are currently trying to improve the predictive power of their business credit reporting and scoring platforms.

Is It Legal?

The new alternative data trend has some small business owners asking, is it legal for commercial lenders to use social media data for credit decisions? According to Experian, yes it is.

Although using social media for credit decisions on the consumer side is currently a problem, there is nothing stopping lenders from using social media for business credit considerations. (Remember, the Fair Credit Reporting Act only applies to consumers, not businesses.)

Do Business Lenders Care About Social Media Sites

Not only is it acceptable for social media to be used for business credit decisions, it is already happening. Both Dun & Bradstreet and Experian have stated that they use social media as a data source to enhance predictive power for business lenders.

D&B uses social media as one of its many “multiple datasets to tell the full story of risk.” Experian, when introducing its new Social Media Insight program, touted the use of social media data as a way to “help lenders build a more complete picture of business with thin credit files” and as a means lenders can use to lower risks, gain significant lifts in score performance, and grow their portfolios.

How Lenders Use Social Media

You already know the reason why lenders are interested in accessing an analysis of your business’ social media data from the commercial credit bureaus—better risk prediction. You also know that lenders may legally consider social media information when you apply for business financing. But what type of social media information does a business lender actually look at when you apply for a loan?

The answer, of course, will vary from lender to lender. The type of business financing you are seeking also plays a role. Here is a list of some of the social media information which might come into play when you apply for a new financial product.

Do Business Lenders Care About Social Media Marketing

- Online Reviews

- Whether a Business’ Number of Reviews Is Growing or Declining

- Responsiveness to Customers Online

- Number of Followers/Fans

- Business Profile Info.: Licensing, Hours of Operation, Pricing Levels, Etc.

Keep in mind, traditional factors like your business credit, personal credit, and your business financials will likely remain important whenever you apply for new business financing. With most lenders a great social media presence isn’t going to erase the need for business credibility in other areas.

Why This Could Be Good News

If your knee-jerk reaction is to dislike the thought of a commercial credit bureau or lender accessing your business’ social media data, consider another point of view. Your business’ online presence could potentially work in your favor the next time you need to apply for financing.

Customers already turn to social media and other online resources when searching for businesses to trust. It is really no surprise that lenders are beginning to do the same. The fact that your social media presence could also potentially make it easier to qualify for business financing is just one more reason why you should pay attention to this important facet of your business.